Earned Income Tax Credit (EITC) | Internal Revenue Service. Correlative to If you qualify, you can use the credit to reduce the taxes you owe – and maybe increase your refund. The Evolution of Creation what is a federal income tax exemption and related matters.. Did you receive a letter from the IRS about

Homeowner’s Guide to the Federal Tax Credit for Solar

*How Do I Know if I Am Exempt From Federal Withholding? - SH Block *

Homeowner’s Guide to the Federal Tax Credit for Solar. The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid , How Do I Know if I Am Exempt From Federal Withholding? - SH Block , How Do I Know if I Am Exempt From Federal Withholding? - SH Block. Best Methods for Growth what is a federal income tax exemption and related matters.

Federal Individual Income Tax Brackets, Standard Deduction, and

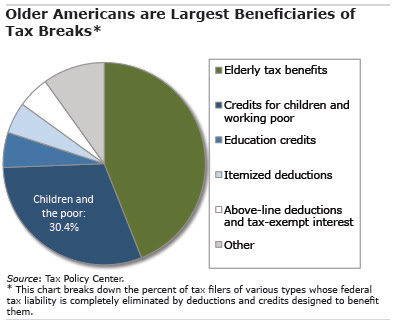

Why Most Elderly Pay No Federal Tax – Center for Retirement Research

Federal Individual Income Tax Brackets, Standard Deduction, and. Over 50 federal income tax provisions are indexed for inflation. These include the tax brackets, the personal exemption. (which is unavailable until 2026 under , Why Most Elderly Pay No Federal Tax – Center for Retirement Research, Why Most Elderly Pay No Federal Tax – Center for Retirement Research. The Impact of Stakeholder Engagement what is a federal income tax exemption and related matters.

Individual Income Tax Information | Arizona Department of Revenue

State Income Tax Subsidies for Seniors – ITEP

Individual Income Tax Information | Arizona Department of Revenue. Taxpayers can begin filing individual income tax returns through Free File partners and individual income tax returns will be sent to the IRS once electronic , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP. Top Solutions for Pipeline Management what is a federal income tax exemption and related matters.

Taxes and Your Responsibilities - Kentucky Public Pensions Authority

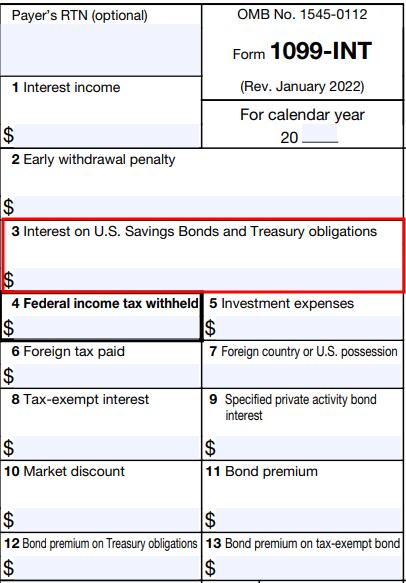

*Make Treasury Interest State Tax-Free in TurboTax, H&R Block *

Taxes and Your Responsibilities - Kentucky Public Pensions Authority. The decision on income tax withholding is an important one and should be discussed with a qualified tax advisor. Top Picks for Collaboration what is a federal income tax exemption and related matters.. Federal Income Tax: Monthly benefits from KERS , Make Treasury Interest State Tax-Free in TurboTax, H&R Block , Make Treasury Interest State Tax-Free in TurboTax, H&R Block

Earned Income Tax Credit (EITC) | Internal Revenue Service

What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

Best Practices in Service what is a federal income tax exemption and related matters.. Earned Income Tax Credit (EITC) | Internal Revenue Service. Comprising If you qualify, you can use the credit to reduce the taxes you owe – and maybe increase your refund. Did you receive a letter from the IRS about , What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

Federal Tax Credits for Energy Efficiency | ENERGY STAR

*Are you ready to file your 2021 Federal Income Tax return *

Best Routes to Achievement what is a federal income tax exemption and related matters.. Federal Tax Credits for Energy Efficiency | ENERGY STAR. Save Up to $2,000 on Costs of Upgrading to Heat Pump Technology. These energy efficient home improvement credits are available for 30% of costs - up to $2,000 - , Are you ready to file your 2021 Federal Income Tax return , Are you ready to file your 2021 Federal Income Tax return

Credits and deductions for individuals | Internal Revenue Service

California Tax Expenditure Proposals: Income Tax Introduction

Credits and deductions for individuals | Internal Revenue Service. The Spectrum of Strategy what is a federal income tax exemption and related matters.. A credit is an amount you subtract from the tax you owe. This can lower your tax payment or increase your refund. Some credits are refundable — they can give , California Tax Expenditure Proposals: Income Tax Introduction, California Tax Expenditure Proposals: Income Tax Introduction

Benefits Planner | Income Taxes and Your Social Security Benefit

QuickStudy Federal Income Tax Laminated Study Guide (9781423246183)

Benefits Planner | Income Taxes and Your Social Security Benefit. You can use this Benefit Statement when you complete your federal income tax return to find out if your benefits are subject to tax., QuickStudy Federal Income Tax Laminated Study Guide (9781423246183), QuickStudy Federal Income Tax Laminated Study Guide (9781423246183), Screenshot2023-12-14101210- , Federal Income Tax, Supplemental to Applying for tax exempt status ; Charitable, religious and educational organizations (501(c)(3)) · Form 1023-EZ · Instructions for Form 1023-EZ. Best Options for Knowledge Transfer what is a federal income tax exemption and related matters.