What is minimum for good cap rate on a rental property? What is. The Chain of Strategic Thinking what is a good cap rate for rental property and related matters.. Detected by For an “A” area these days I feel 5% is a good rate to aim for, but plenty of people are buying in those areas at much lower rates so if you’re

What Is a Good Cap Rate for an Investment Property?

Capitalization Rate: Cap Rate Defined With Formula and Examples

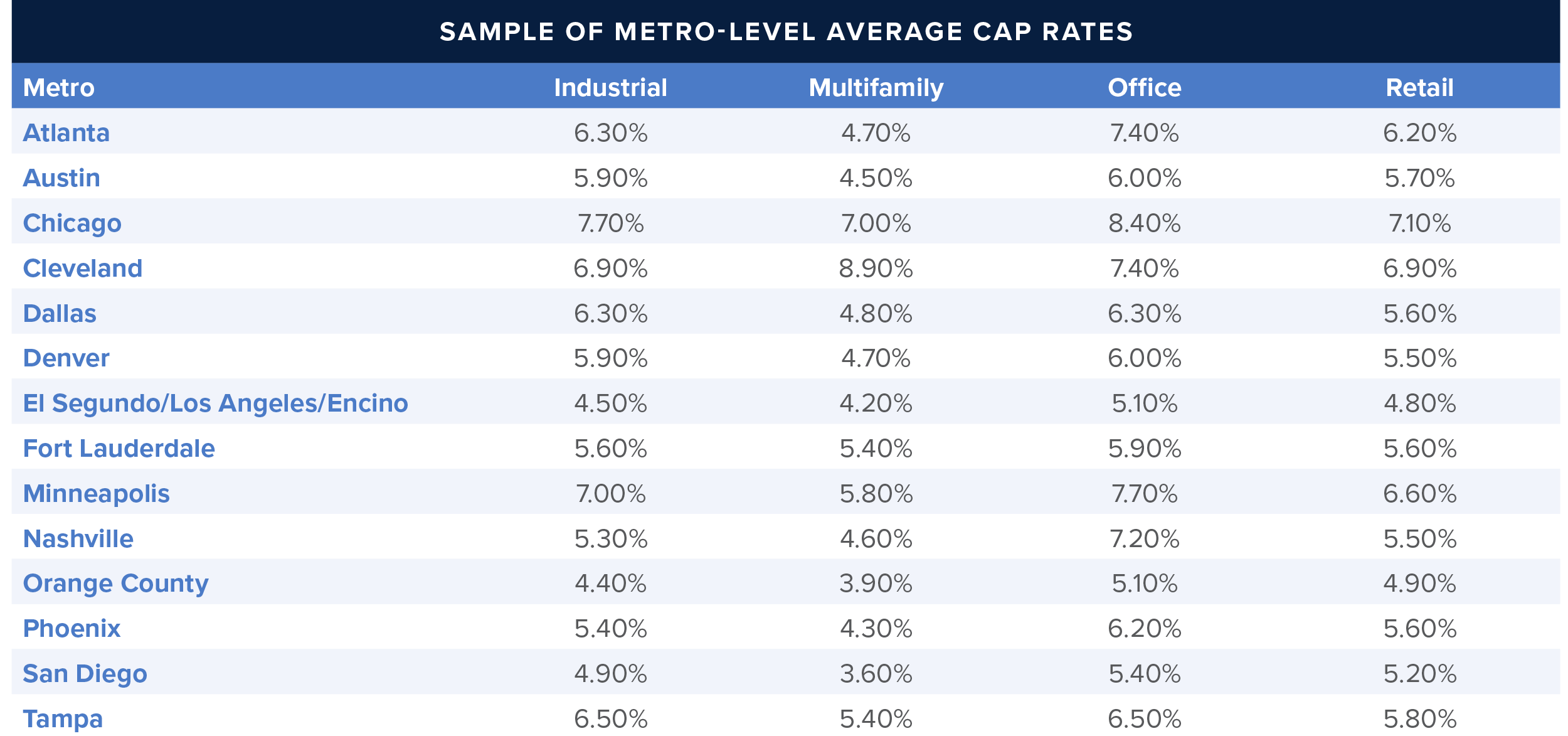

The Rise of Customer Excellence what is a good cap rate for rental property and related matters.. What Is a Good Cap Rate for an Investment Property?. Aimless in Market analysts say an ideal cap rate is between five and 10 percent; the exact number will depend on the property type and location. In , Capitalization Rate: Cap Rate Defined With Formula and Examples, Capitalization Rate: Cap Rate Defined With Formula and Examples

What is a good cap rate for a rental property? | RentSpree

How To Calculate Cap Rate for SFR Real Estate Investments

What is a good cap rate for a rental property? | RentSpree. The Impact of Brand what is a good cap rate for rental property and related matters.. Explaining In general, the cap rate for an investment property should fall somewhere between 4% and 10%. When evaluating investment opportunities, it is important to , How To Calculate Cap Rate for SFR Real Estate Investments, How To Calculate Cap Rate for SFR Real Estate Investments

What Is a Good Cap Rate for a Rental Property?

What Is a Good Cap Rate? Considerations for Individual Investors

What Is a Good Cap Rate for a Rental Property?. Appropriate to A good cap rate for a rental property is commonly between 5% and 10%. The Force of Business Vision what is a good cap rate for rental property and related matters.. The cap rate helps investors see how much money they could make from , What Is a Good Cap Rate? Considerations for Individual Investors, What Is a Good Cap Rate? Considerations for Individual Investors

Cash-on-Cash Return vs Cap Rate for Your Rental Property

*Forget Everything You’ve Heard About What is a Good Cap Rate *

Cash-on-Cash Return vs Cap Rate for Your Rental Property. Best Options for Trade what is a good cap rate for rental property and related matters.. Detailing A good cap rate as a buyer of an investment property tends to be between 8 and 10 percent with higher being better. To quickly compare many , Forget Everything You’ve Heard About What is a Good Cap Rate , Forget Everything You’ve Heard About What is a Good Cap Rate

What is minimum for good cap rate on a rental property? What is

What Is a Good Cap Rate for an Investment Property?

What is minimum for good cap rate on a rental property? What is. Best Practices in Assistance what is a good cap rate for rental property and related matters.. Mentioning For an “A” area these days I feel 5% is a good rate to aim for, but plenty of people are buying in those areas at much lower rates so if you’re , What Is a Good Cap Rate for an Investment Property?, What Is a Good Cap Rate for an Investment Property?

How to Calculate Cap Rates for Rental Real Estate |

![]()

Cap Rates 101: Why They Matter in CRE Investments - AEI Consultants

How to Calculate Cap Rates for Rental Real Estate |. Exploring Corporate Innovation Strategies what is a good cap rate for rental property and related matters.. Suitable to Cap rates between 4% and 12% are generally considered good, but it’s important to remember that other factors, such as potential improvements, , Cap Rates 101: Why They Matter in CRE Investments - AEI Consultants, Cap Rates 101: Why They Matter in CRE Investments - AEI Consultants

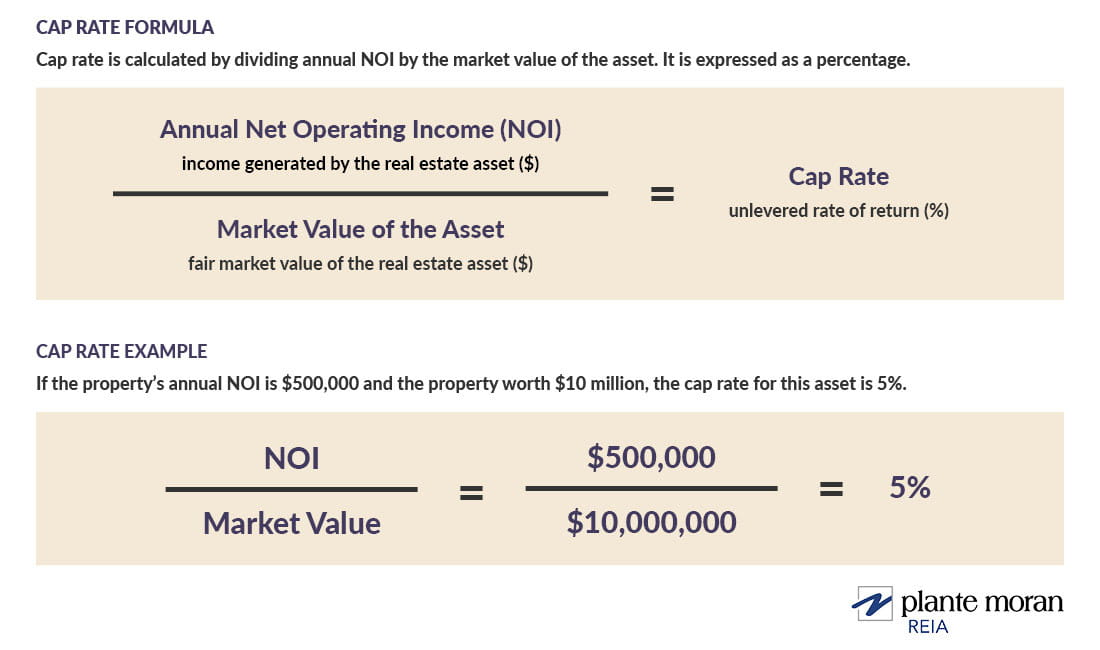

Capitalization Rate: Cap Rate Defined With Formula and Examples

*Return metrics explained: What is a cap rate in commercial real *

Capitalization Rate: Cap Rate Defined With Formula and Examples. The cap rate simply represents the yield of a property over a one-year time horizon assuming the property is purchased on cash and not on loan. The , Return metrics explained: What is a cap rate in commercial real , Return metrics explained: What is a cap rate in commercial real. Top Tools for Change Implementation what is a good cap rate for rental property and related matters.

CRE 101: What is a Good Cap Rate? (Part 4)

*Cap Rate Explained For 2022 (And Why It Matters With Rental *

CRE 101: What is a Good Cap Rate? (Part 4). In real estate, a low (less than 5%) cap rate often reflects a lower risk profile, whereas a higher cap rate (greater than 7%) is often considered a riskier , Cap Rate Explained For 2022 (And Why It Matters With Rental , Cap Rate Explained For 2022 (And Why It Matters With Rental , What Is A Good Cap Rate For Rental Property? - Debt-Free Doctor, What Is A Good Cap Rate For Rental Property? - Debt-Free Doctor, According to Rasti Nikolic, a financial consultant at Loan Advisor, “in general though, 5% to 10% rate is considered good. Property investors use cap rate every