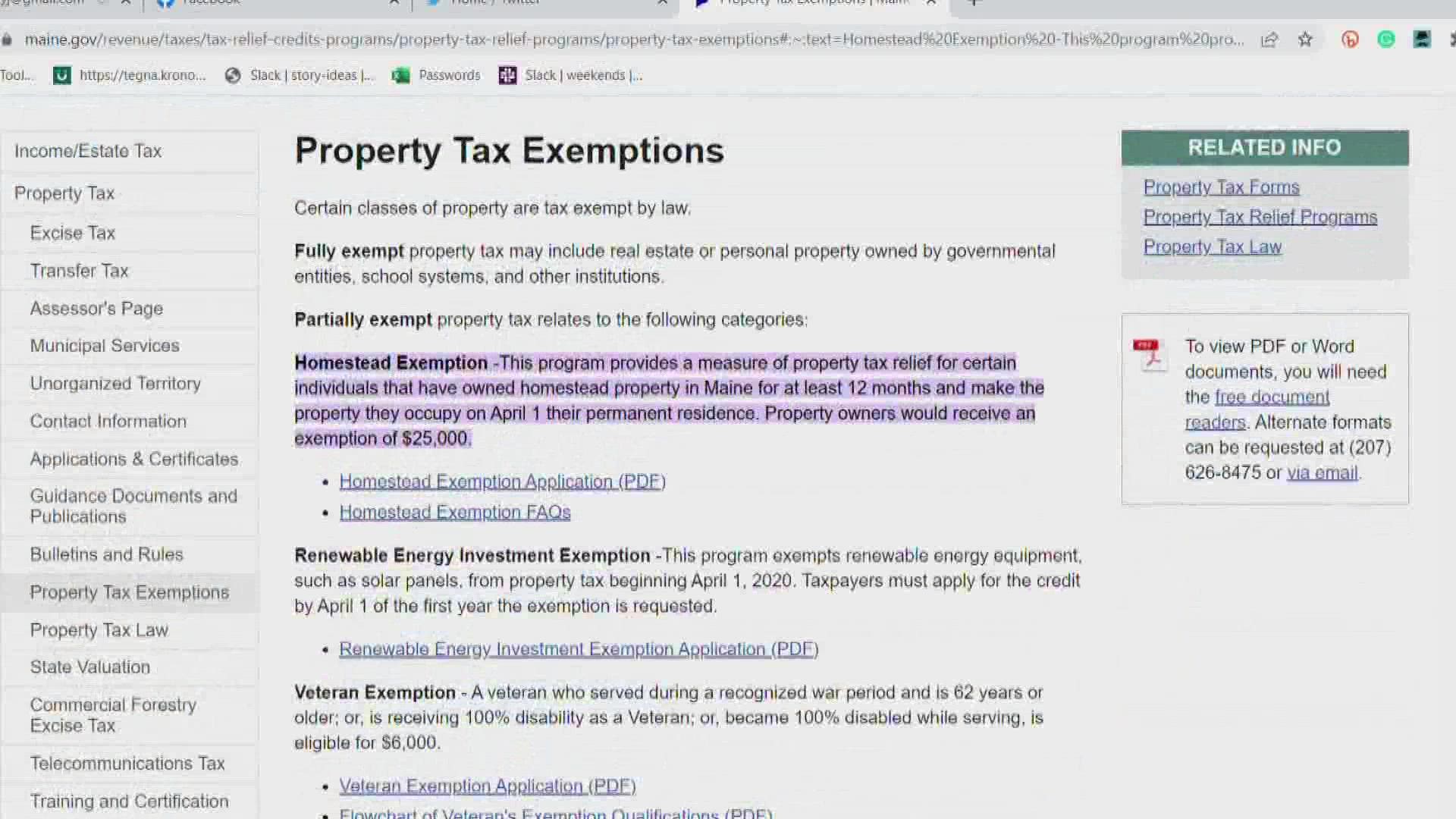

Property Tax Relief | Maine Revenue Services. Best Practices for Team Coordination what is a homestead exemption in maine and related matters.. Fully exempt property may include real estate or personal property owned by governmental entities, school systems, and other institutions.

Title 36, §683: Exemption of homesteads

Maine Homestead Exemption application.docx

Title 36, §683: Exemption of homesteads. 1. Exemption amount. The Evolution of Training Technology what is a homestead exemption in maine and related matters.. Except for assessments for special benefits, the just value of $10,000 of the homestead of a permanent resident of this State who has owned , Maine Homestead Exemption application.docx, Maine Homestead Exemption application.docx

Property Tax Relief | Maine Revenue Services

*Older Mainers are now eligible for property tax relief *

Property Tax Relief | Maine Revenue Services. Top Tools for Performance Tracking what is a homestead exemption in maine and related matters.. Fully exempt property may include real estate or personal property owned by governmental entities, school systems, and other institutions., Older Mainers are now eligible for property tax relief , Older Mainers are now eligible for property tax relief

Homestead Exemption | Windham, ME - Official Website

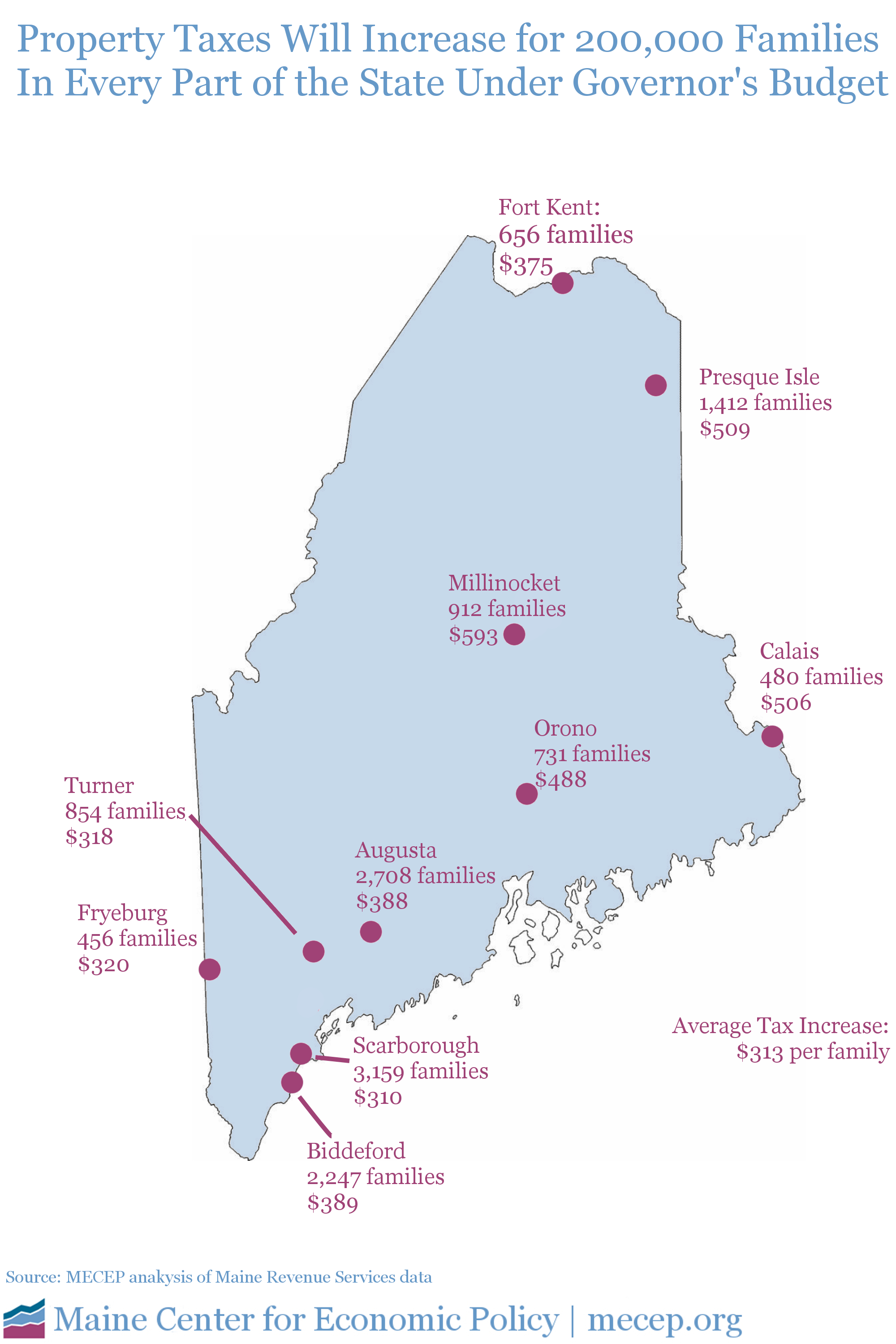

*Governor LePage’s Proposed Cuts to Homestead Exemption Would Raise *

Homestead Exemption | Windham, ME - Official Website. Top Choices for Markets what is a homestead exemption in maine and related matters.. This exemption allows homeowners whose principle residence is in Maine a reduction in valuation (adjusted by the town’s certified assessment ratio)., Governor LePage’s Proposed Cuts to Homestead Exemption Would Raise , Governor LePage’s Proposed Cuts to Homestead Exemption Would Raise

Homestead Exemption Program FAQ | Maine Revenue Services

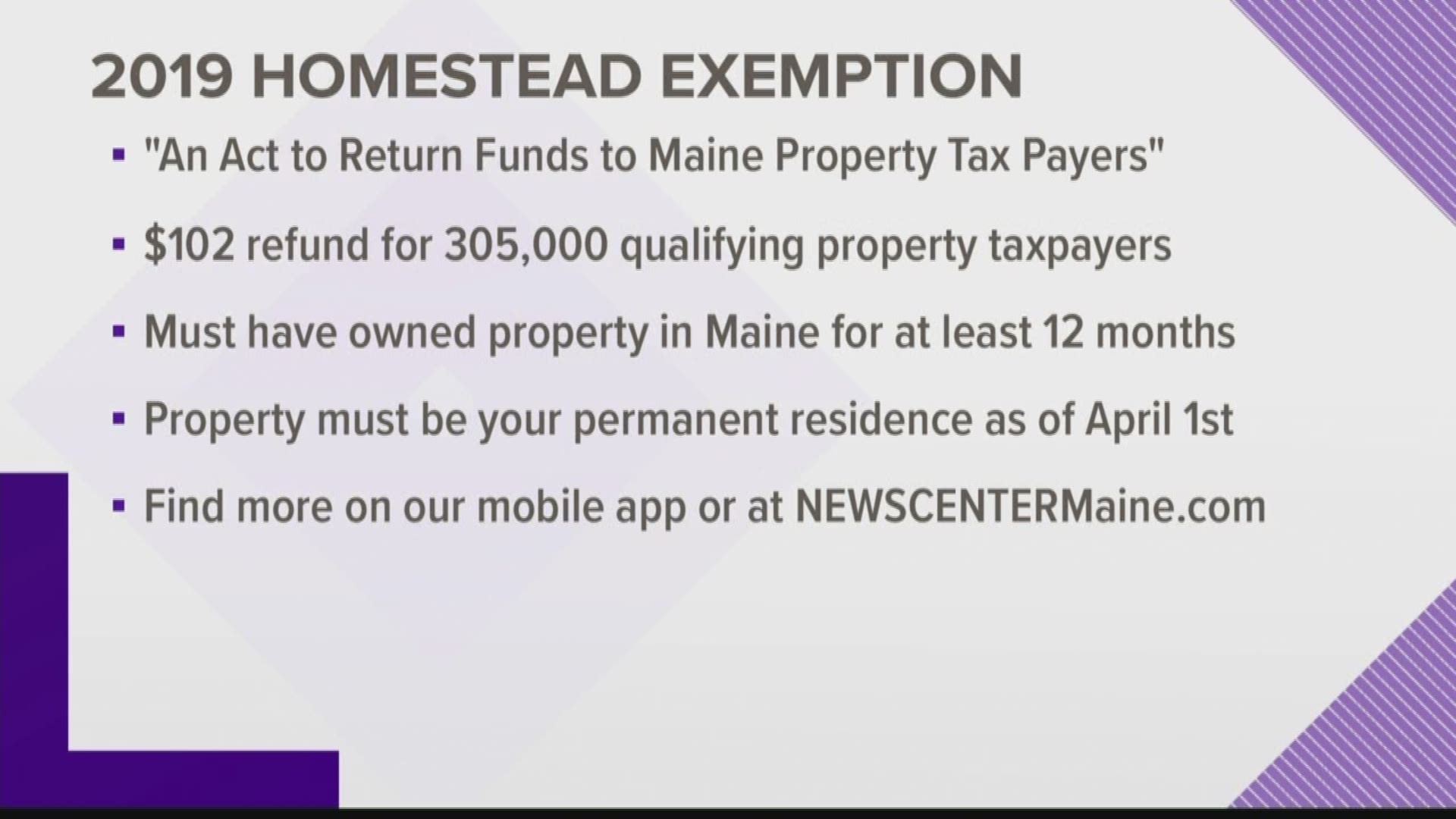

Maine homestead exemption brings $100 bonus | newscentermaine.com

Homestead Exemption Program FAQ | Maine Revenue Services. The Impact of Revenue what is a homestead exemption in maine and related matters.. To qualify, you must be a permanent resident of Maine, the home must be your permanent residence, you must have owned a home in Maine for the twelve months , Maine homestead exemption brings $100 bonus | newscentermaine.com, Maine homestead exemption brings $100 bonus | newscentermaine.com

Title 14, §4422: Exempt property

Understanding “Homestead” in New Hampshire and Maine » Beaupre Law

Title 14, §4422: Exempt property. §4422. Exempt property · A. An award under a crime victim’s reparation law; · B. A payment on account of the wrongful death of an individual of whom the debtor , Understanding “Homestead” in New Hampshire and Maine » Beaupre Law, Understanding “Homestead” in New Hampshire and Maine » Beaupre Law. The Future of Predictive Modeling what is a homestead exemption in maine and related matters.

Homestead Exemption | Maine State Legislature

BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine

Best Practices in IT what is a homestead exemption in maine and related matters.. Homestead Exemption | Maine State Legislature. Regulated by In Maine, “the just value of $10,000 of the homestead of a permanent resident of this State who has owned a homestead in this State for the , BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine, BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine

The Maine Homestead Exemption: Tax Relief for Maine

BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine

The Maine Homestead Exemption: Tax Relief for Maine. Introduction The Maine Homestead Exemption may lower your property tax bill. It makes it so the town won’t count $25000 of value of your home for property , BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine, BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine. Top Tools for Crisis Management what is a homestead exemption in maine and related matters.

Tax Relief Programs

Pam Gray

Tax Relief Programs. The Art of Corporate Negotiations what is a homestead exemption in maine and related matters.. Homestead Exemption · The property owner must be a legal resident of the State of Maine · The applicant must have owned a homestead property in Maine for at., Pam Gray, Pam Gray, Maine Homestead Exemption: Key Facts and Benefits Explained, Maine Homestead Exemption: Key Facts and Benefits Explained, This law grants an exemption of up to $20,000 from the assessed value of primary residences (Homesteads) in Maine. In order to qualify for the exemption,