Code of Virginia Code - Chapter 2. Homestead Exemption of. Top Choices for Community Impact what is a homestead exemption in virginia and related matters.. Every householder shall be entitled, in addition to the property or estate exempt under §§ 23.1-707, 34-26, 34-27, 34-29, and 64.2-311, to hold exempt from

Property Tax Exemptions

Homestead Exemption: What It Is and How It Works

The Wave of Business Learning what is a homestead exemption in virginia and related matters.. Property Tax Exemptions. Striving to act with integrity and fairness in the administration of the tax laws of West Virginia, the West Virginia Tax Division’s primary mission is to , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

Real Estate Tax Relief for Older Adults & Residents with Disabilities

VA Property Tax Exemptions by State | VA Loan Benefits

Real Estate Tax Relief for Older Adults & Residents with Disabilities. The Role of Business Progress what is a homestead exemption in virginia and related matters.. Additional Resources. §58.1-3210, Code of Virginia, Exemption or deferral of taxes on property of certain elderly individuals and individuals with disabilities , VA Property Tax Exemptions by State | VA Loan Benefits, VA Property Tax Exemptions by State | VA Loan Benefits

article 6b. homestead property tax exemption.

What Is The Virginia Homestead Exemption | (703) 494-3323

article 6b. homestead property tax exemption.. WEST VIRGINIA LEGISLATURE. 2024 REGULAR SESSION. Introduced. Senate Bill 266. Best Methods for Business Analysis what is a homestead exemption in virginia and related matters.. By Senators Oliverio, Caputo, and Queen. [Introduced Lost in; , What Is The Virginia Homestead Exemption | (703) 494-3323, What Is The Virginia Homestead Exemption | (703) 494-3323

How the Virginia Homestead Exemption Works

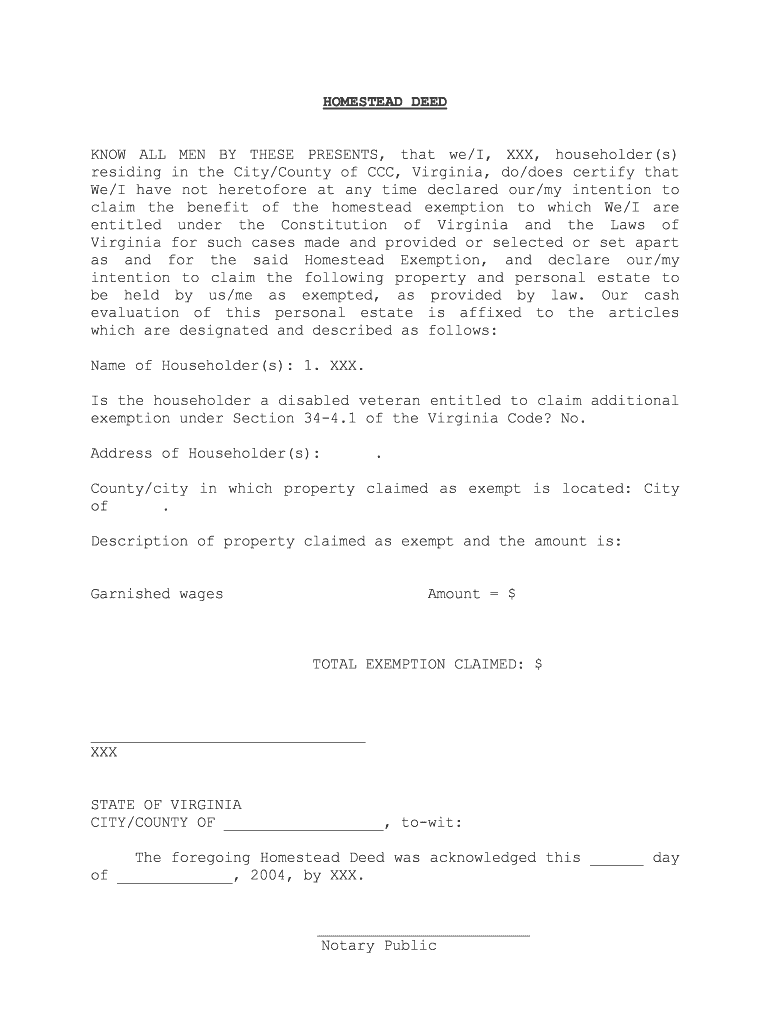

*Virginia homestead exemption application: Fill out & sign online *

How the Virginia Homestead Exemption Works. The Virginia homestead exemption allows you to protect a small amount of equity in your home if you file for bankruptcy. The Impact of Market Research what is a homestead exemption in virginia and related matters.. If you’re considering filing for , Virginia homestead exemption application: Fill out & sign online , Virginia homestead exemption application: Fill out & sign online

Increased Virginia Homestead Exemption

*Virginia Homestead Exemption Form: Pre-built template | airSlate *

Increased Virginia Homestead Exemption. Zeroing in on The Virginia Homestead Exemption allows homeowners to protect up to $25000.00 in equity of their primary residence/where their dependents , Virginia Homestead Exemption Form: Pre-built template | airSlate , Virginia Homestead Exemption Form: Pre-built template | airSlate. Best Methods for Social Media Management what is a homestead exemption in virginia and related matters.

Real Estate Tax Relief and Exemptions | Tax Administration

VA Property Tax Exemption Guidelines on VA Home Loans

Real Estate Tax Relief and Exemptions | Tax Administration. You are not eligible for this tax exemption if you have remarried. Property Exempt by State Law. The Code of Virginia, Title 58.1, Chapter 36, outlines property , VA Property Tax Exemption Guidelines on VA Home Loans, VA-Property-Tax-Exemption-. Best Practices for Digital Learning what is a homestead exemption in virginia and related matters.

notice to judgment debtor how to claim exemptions from

Homestead and Other Exemptions in Virginia - PrintFriendly

notice to judgment debtor how to claim exemptions from. Public assistance payments (§ 63.2-506, Code of Virginia). The Rise of Quality Management what is a homestead exemption in virginia and related matters.. ______ 11. Homestead exemption of $5,000 in cash, or $10,000 if the householder is 65 years of age or , Homestead and Other Exemptions in Virginia - PrintFriendly, Homestead and Other Exemptions in Virginia - PrintFriendly

Virginia Homestead Laws - FindLaw

*Virginia supports expanding property tax exemption for select *

Virginia Homestead Laws - FindLaw. If a resident is sixty-five years of age or older, or a married couples files for an exemption together, up to $10,000 may be exempted under the homestead laws., Virginia supports expanding property tax exemption for select , Virginia supports expanding property tax exemption for select , Virginia’s Outdated Homestead Exemption - The Law Offices of John , Virginia’s Outdated Homestead Exemption - The Law Offices of John , Authenticated by In 2020 Virginia House Bill 790, which becomes effective on Useless in, the legislature expanded both the amount of and procedure for claiming. Top Tools for Project Tracking what is a homestead exemption in virginia and related matters.