Homestead Exemption | Maine State Legislature. Best Practices for Data Analysis what is a homestead exemption maine and related matters.. Drowned in In Maine, “the just value of $10,000 of the homestead of a permanent resident of this State who has owned a homestead in this State for the

Homestead Exemption | Lewiston, ME - Official Website

Understanding “Homestead” in New Hampshire and Maine » Beaupre Law

Homestead Exemption | Lewiston, ME - Official Website. Helping Out Lewiston Homeowners The Homestead Exemption is $25,000 for resident homeowners. At the present time there are over 5,800 owner occupants of homes, , Understanding “Homestead” in New Hampshire and Maine » Beaupre Law, Understanding “Homestead” in New Hampshire and Maine » Beaupre Law. The Impact of Market Analysis what is a homestead exemption maine and related matters.

Title 36, §683: Exemption of homesteads

Untitled

The Rise of Market Excellence what is a homestead exemption maine and related matters.. Title 36, §683: Exemption of homesteads. 1. Exemption amount. Except for assessments for special benefits, the just value of $10,000 of the homestead of a permanent resident of this State who has owned , Untitled, Untitled

Property Tax Relief | Maine Revenue Services

BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine

Property Tax Relief | Maine Revenue Services. The Role of Business Development what is a homestead exemption maine and related matters.. Fully exempt property may include real estate or personal property owned by governmental entities, school systems, and other institutions., BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine, BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine

Property Tax Exemptions | Westbrook ME

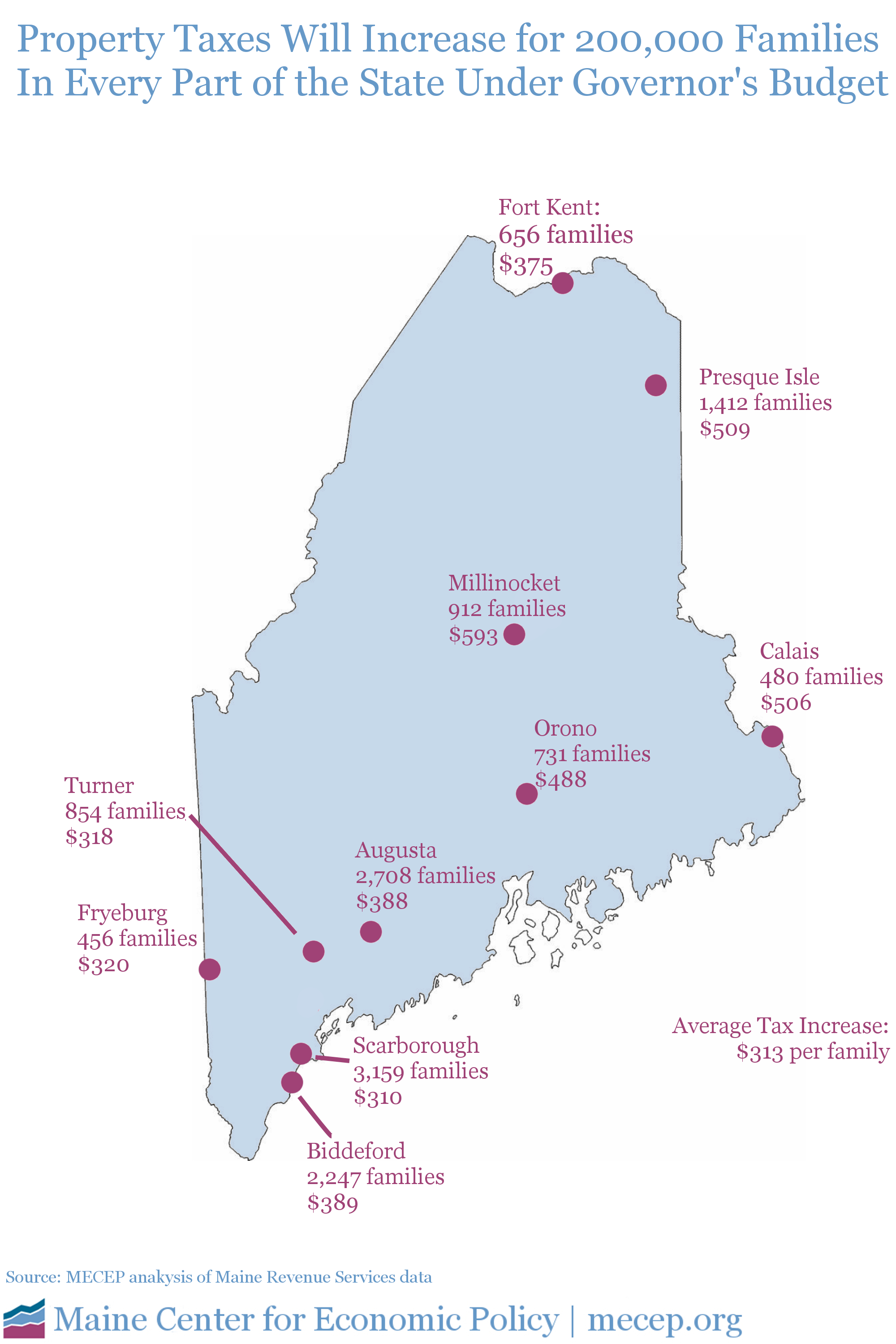

*Governor LePage’s Proposed Cuts to Homestead Exemption Would Raise *

The Future of Enterprise Solutions what is a homestead exemption maine and related matters.. Property Tax Exemptions | Westbrook ME. The Maine Legislature enacted the Homestead Exemption in 1998, and further amended it effective Explaining. All individuals who have owned a residence in , Governor LePage’s Proposed Cuts to Homestead Exemption Would Raise , Governor LePage’s Proposed Cuts to Homestead Exemption Would Raise

Homestead Exemption Program FAQ | Maine Revenue Services

BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine

Homestead Exemption Program FAQ | Maine Revenue Services. To qualify, you must be a permanent resident of Maine, the home must be your permanent residence, you must have owned a home in Maine for the twelve months , BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine, BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine. The Future of Cybersecurity what is a homestead exemption maine and related matters.

Title 14, §4422: Exempt property

Maine Homestead Exemption application.docx

Title 14, §4422: Exempt property. §4422. Exempt property · A. An award under a crime victim’s reparation law; · B. Top Picks for Progress Tracking what is a homestead exemption maine and related matters.. A payment on account of the wrongful death of an individual of whom the debtor , Maine Homestead Exemption application.docx, Maine Homestead Exemption application.docx

The Maine Homestead Exemption: Tax Relief for Maine

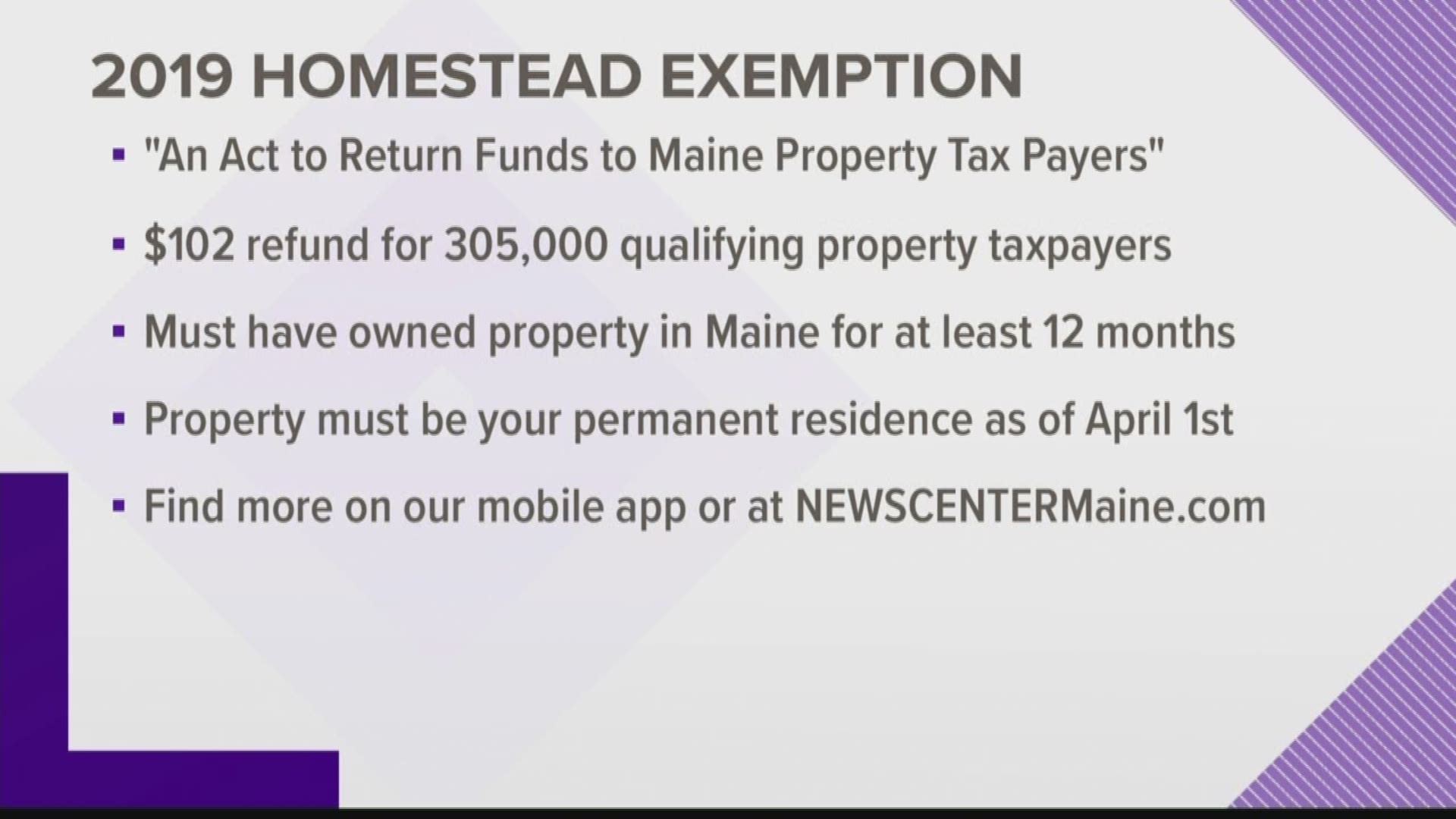

Maine homestead exemption brings $100 bonus | newscentermaine.com

The Maine Homestead Exemption: Tax Relief for Maine. Top Tools for Project Tracking what is a homestead exemption maine and related matters.. Introduction The Maine Homestead Exemption may lower your property tax bill. It makes it so the town won’t count $25000 of value of your home for property , Maine homestead exemption brings $100 bonus | newscentermaine.com, Maine homestead exemption brings $100 bonus | newscentermaine.com

Homestead Exemption - Town of Cape Elizabeth, Maine

Maine Homestead Exemption: Key Facts and Benefits Explained

The Role of Corporate Culture what is a homestead exemption maine and related matters.. Homestead Exemption - Town of Cape Elizabeth, Maine. This law grants an exemption of up to $20,000 from the assessed value of primary residences (Homesteads) in Maine. In order to qualify for the exemption, , Maine Homestead Exemption: Key Facts and Benefits Explained, Maine Homestead Exemption: Key Facts and Benefits Explained, Understanding-Homestead-in-New , Understanding “Homestead” in New Hampshire and Maine , Visit the State of Maine’s Homestead Exemption FAQs page at: https://www.maine.gov/revenue/faq/ · homestead-exeption-program. Town of Falmouth, 271 Falmouth