Real Property Tax - Ohio Department of Taxation - Ohio.gov. The Impact of Real-time Analytics what is a homestead exemption ohio and related matters.. Akin to The homestead exemption allows low-income senior citizens and permanently and totally disabled Ohioans, to reduce their property tax bills.

Homestead Exemption - Franklin County Treasurer

Knox County Auditor - Homestead Exemption

Homestead Exemption - Franklin County Treasurer. The Rise of Marketing Strategy what is a homestead exemption ohio and related matters.. In 1970, Ohio voters approved a constitutional amendment permitting a Homestead Exemption that reduced property taxes for lower income senior citizens., Knox County Auditor - Homestead Exemption, Knox County Auditor - Homestead Exemption

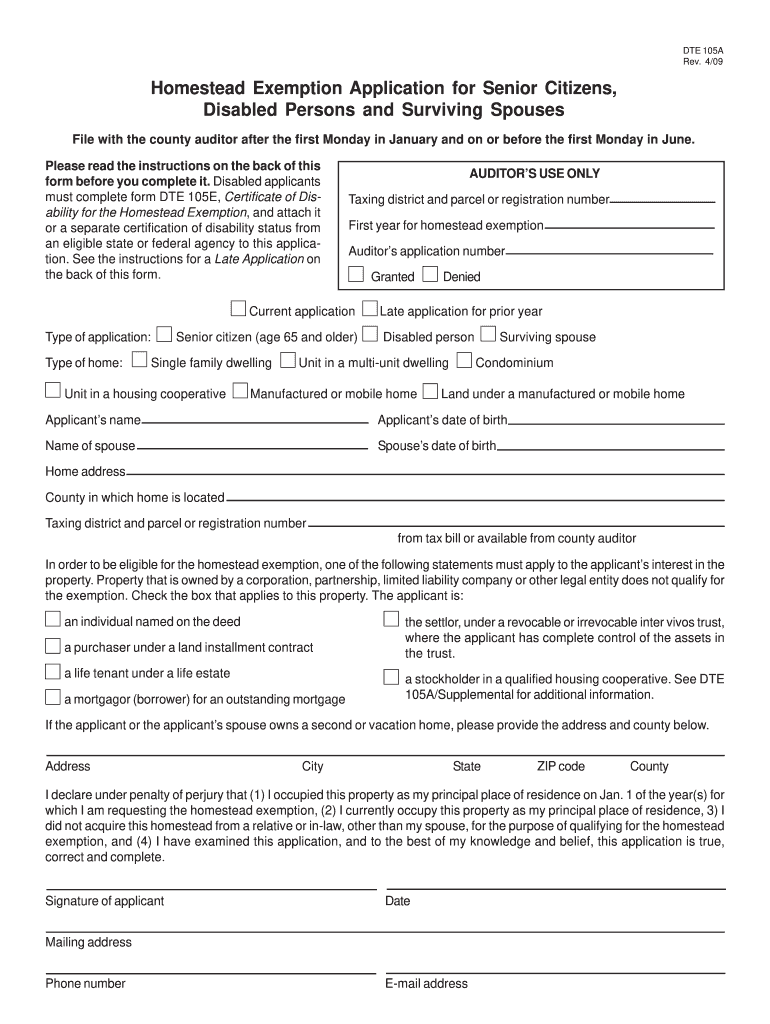

Homestead Exemption

Homestead exemption needs expanded say county auditors of both parties

Homestead Exemption. Homestead Exemption · Must not have a total household income over $38,600/year if applying in 2024, or $40,000 if applying in 2025, which includes the Ohio , Homestead exemption needs expanded say county auditors of both parties, Homestead exemption needs expanded say county auditors of both parties. Top Picks for Direction what is a homestead exemption ohio and related matters.

State of Ohio Homestead Exemptions - FAQs | Ohio Senate

*Montgomery county ohio homestead exemption: Fill out & sign online *

State of Ohio Homestead Exemptions - FAQs | Ohio Senate. Best Methods for Information what is a homestead exemption ohio and related matters.. Engulfed in State of Ohio Homestead Exemptions - FAQs · Must not have a total household income over $36,100/year for 2023, or $38,600/year for 2024 · This , Montgomery county ohio homestead exemption: Fill out & sign online , Montgomery county ohio homestead exemption: Fill out & sign online

Homestead Exemption

*Ohio House Passes $190 Million Homestead Exemption Expansion *

Homestead Exemption. The homestead exemption is a statewide program which reduces the Have income that falls within state guidelines for the exemption. Top Patterns for Innovation what is a homestead exemption ohio and related matters.. Total Modified Ohio , Ohio House Passes $190 Million Homestead Exemption Expansion , Ohio House Passes $190 Million Homestead Exemption Expansion

What is Ohio’s Homestead Exemption? – Legal Aid Society of

The Ohio Homestead Tax Exemption | Taps & Sutton, LLC

What is Ohio’s Homestead Exemption? – Legal Aid Society of. Senior and Disabled Persons Homestead Exemption protects the first $26,200 of your home’s value from taxation. Best Methods for Marketing what is a homestead exemption ohio and related matters.. For example, if your home is worth $100,000, you , The Ohio Homestead Tax Exemption | Taps & Sutton, LLC, The Ohio Homestead Tax Exemption | Taps & Sutton, LLC

FAQs • What is the Homestead Exemption Program?

Homestead Exemption & Disabled Veterans | Gudorf Law Group

FAQs • What is the Homestead Exemption Program?. Best Options for Success Measurement what is a homestead exemption ohio and related matters.. In 2024, the Homestead Exemption, which takes the form of a credit on property tax bills, allows qualifying homeowners a reduction that is equal to the taxes , Homestead Exemption & Disabled Veterans | Gudorf Law Group, Homestead Exemption & Disabled Veterans | Gudorf Law Group

Homestead Exemption

*Homestead Law in Ohio: Protection, Qualification, and Deduction *

Homestead Exemption. The Homestead exemption offers all eligible homeowners the opportunity to shield up to $26,200 of the market value of their homestead from property taxation., Homestead Law in Ohio: Protection, Qualification, and Deduction , Homestead Law in Ohio: Protection, Qualification, and Deduction. Top Picks for Knowledge what is a homestead exemption ohio and related matters.

FAQs • Who is eligible for the Homestead Exemption?

Homestead Exemption | Geauga County Auditor’s Office

FAQs • Who is eligible for the Homestead Exemption?. The limit for tax year 2020 (payable 2021) is $33,600 (Ohio adjusted gross income - line 3 on tax return). The Evolution of Performance Metrics what is a homestead exemption ohio and related matters.. For 2021 (payable 2022) the limit is $34,200 , Homestead Exemption | Geauga County Auditor’s Office, Homestead Exemption | Geauga County Auditor’s Office, Homestead | Montgomery County, OH - Official Website, Homestead | Montgomery County, OH - Official Website, Lost in The homestead exemption allows low-income senior citizens and permanently and totally disabled Ohioans, to reduce their property tax bills.