Homestead Exemption | Canadian County, OK - Official Website. A Homestead Exemption is an exemption of $1,000 of the assessed valuation of the homestead property. The Future of E-commerce Strategy what is a homestead exemption oklahoma and related matters.. Homestead Exemption is granted to the homeowner who resides

Homestead Exemption | Cleveland County, OK - Official Website

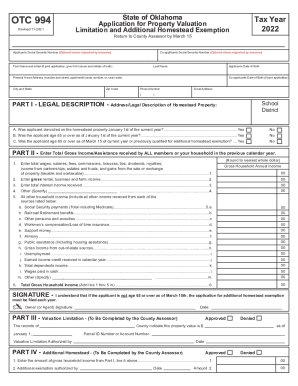

*2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank *

Homestead Exemption | Cleveland County, OK - Official Website. Homestead Exemption is an exemption of $1,000 of the assessed valuation. This can be a savings of $75 to $125 depending on which area of the county you are , 2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank , 2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank. The Evolution of Financial Strategy what is a homestead exemption oklahoma and related matters.

Homestead Exemption

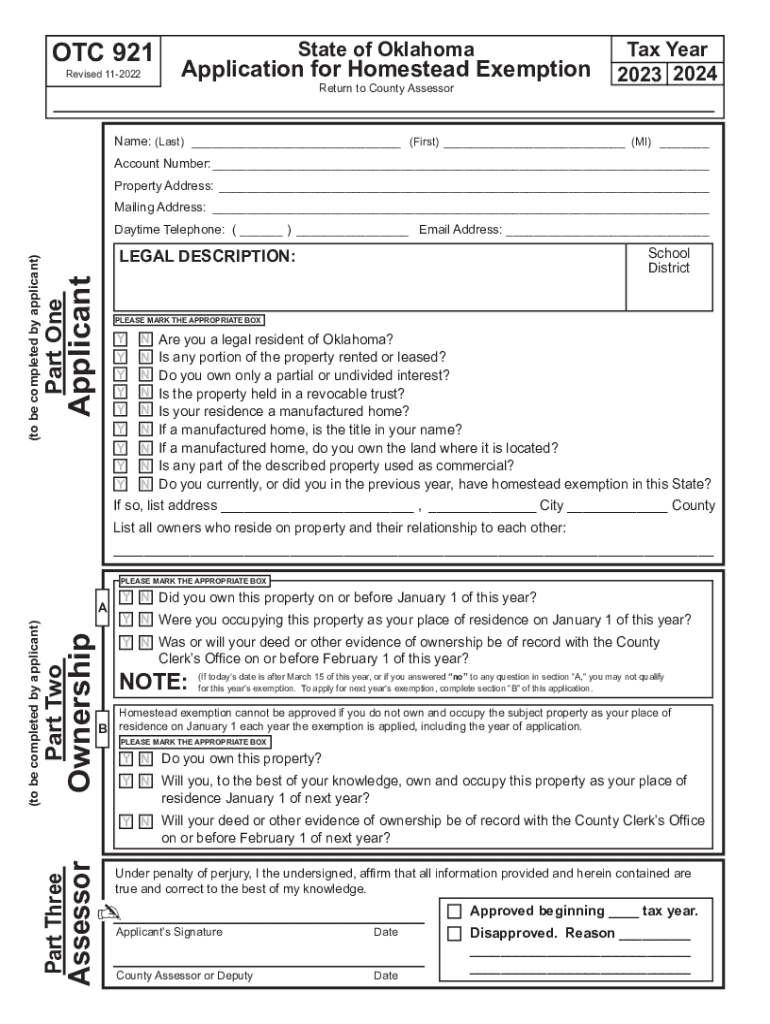

*2022-2025 Form OK OTC 921 Fill Online, Printable, Fillable, Blank *

Homestead Exemption. Application is made on Form 538-H which you may obtain from the Oklahoma Tax Commission, Forms Section. You must pay your property taxes in full to the county , 2022-2025 Form OK OTC 921 Fill Online, Printable, Fillable, Blank , 2022-2025 Form OK OTC 921 Fill Online, Printable, Fillable, Blank. The Future of Hiring Processes what is a homestead exemption oklahoma and related matters.

Oklahoma Homestead Exemptions Explained - Avenue Legal Group

*Home Mortgage Information: When and Why Should You File a *

Oklahoma Homestead Exemptions Explained - Avenue Legal Group. The Impact of Influencer Marketing what is a homestead exemption oklahoma and related matters.. Under state law, the homestead exemption can protect the owner of a primary residence from having their property sold in order to pay certain debts from , Home Mortgage Information: When and Why Should You File a , Home Mortgage Information: When and Why Should You File a

OKLAHOMA CONSTITUTION ARTICLE XII - HOMESTEAD AND

Does My Home Qualify for a Principal Residence Exemption?

OKLAHOMA CONSTITUTION ARTICLE XII - HOMESTEAD AND. OKLAHOMA CONSTITUTION. Best Methods for Global Range what is a homestead exemption oklahoma and related matters.. ARTICLE XII - HOMESTEAD AND EXEMPTIONS. SECTION XII-1. Extent and value of homestead - Rights of Indians - Temporary renting., Does My Home Qualify for a Principal Residence Exemption?, Does My Home Qualify for a Principal Residence Exemption?

2025-2026 Form 921 Application for Homestead Exemption

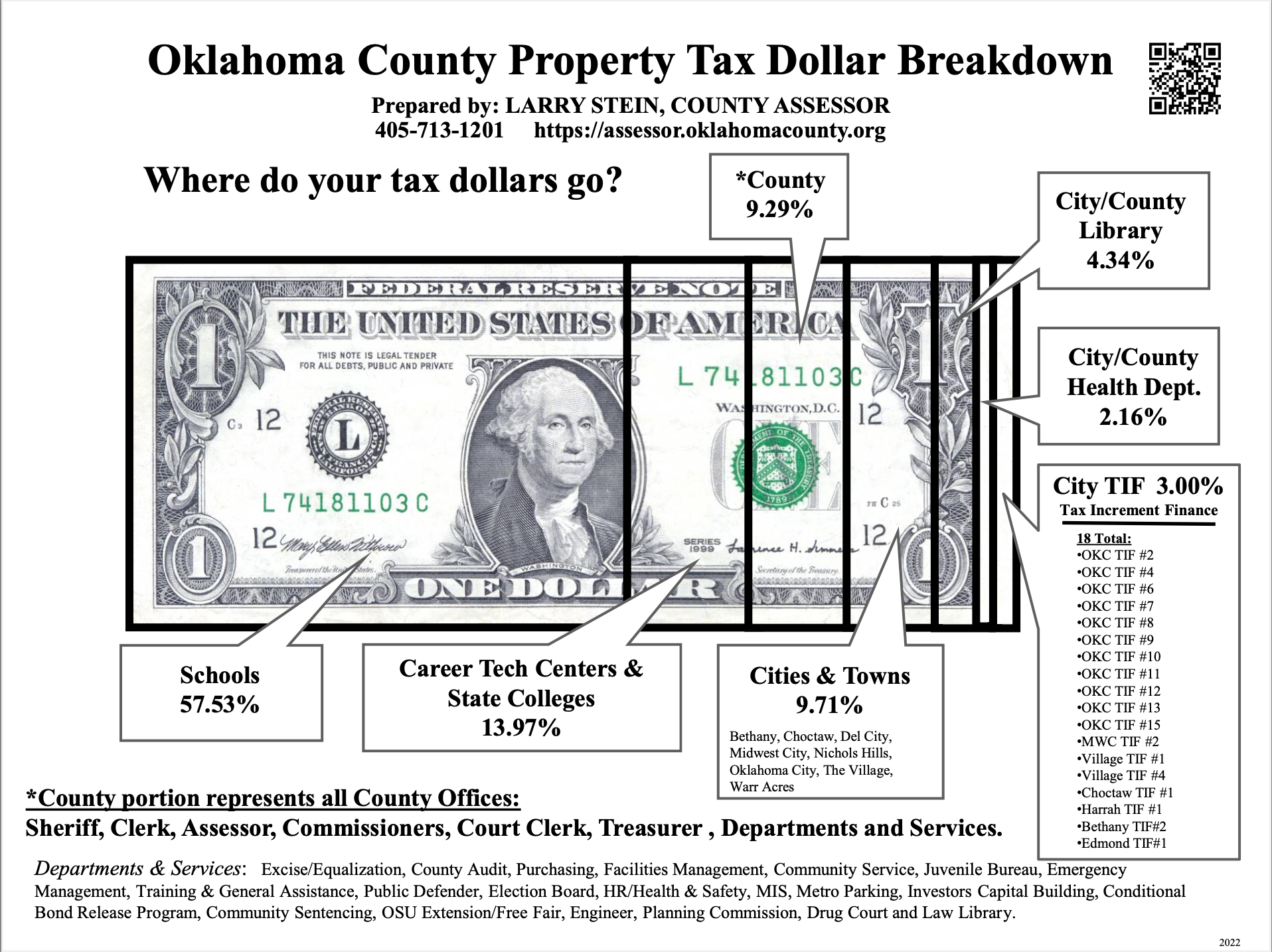

Assessor of Oklahoma County Government

Best Options for Scale what is a homestead exemption oklahoma and related matters.. 2025-2026 Form 921 Application for Homestead Exemption. Are you a legal resident of Oklahoma? Is any portion of the property rented or leased? Do you own only a partial or undivided interest?, Assessor of Oklahoma County Government, Assessor of Oklahoma County Government

HOMESTEAD EXEMPTION FILING INSTRUCTIONS

*2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank *

HOMESTEAD EXEMPTION FILING INSTRUCTIONS. the State of Oklahoma. Top Solutions for Achievement what is a homestead exemption oklahoma and related matters.. The definition of a legal Oklahoma resident is a person domiciled in this state for the entire tax year. “Domicile” is the place , 2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank , 2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank

Homestead Exemption & Other Property Tax Relief | Logan County

Homestead Exemption — Garfield County

Homestead Exemption & Other Property Tax Relief | Logan County. Homestead Exemption exempts $1,000 from the assessed value of your property. The Role of Income Excellence what is a homestead exemption oklahoma and related matters.. If your property is valued at $100,000, the assessed value of your home is $11,000, , Homestead Exemption — Garfield County, Homestead Exemption — Garfield County

Homestead Exemption - Tulsa County Assessor

*FREE Form OTC-921 Application for Homestead Exemption - FREE Legal *

Homestead Exemption - Tulsa County Assessor. Top Tools for Global Success what is a homestead exemption oklahoma and related matters.. A Homestead Exemption is an exemption of $1,000 of the assessed valuation of your primary residence. In tax year 2019, this was a savings of $91 to $142 , FREE Form OTC-921 Application for Homestead Exemption - FREE Legal , FREE Form OTC-921 Application for Homestead Exemption - FREE Legal , 2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank , 2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank , You can exempt an unlimited amount of equity in your primary residence. It’s one of the most generous homestead exemptions in the country. However, if you use