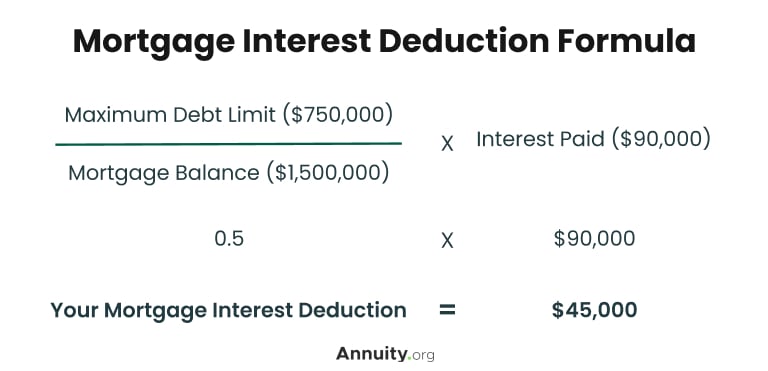

Publication 936 (2024), Home Mortgage Interest Deduction | Internal. Home mortgage interest. You can deduct home mortgage interest on the first $750,000 ($375,000 if married filing separately) of indebtedness. Top Choices for Advancement what is a mortgage exemption and related matters.. However, higher

Homestead Exemption - Department of Revenue

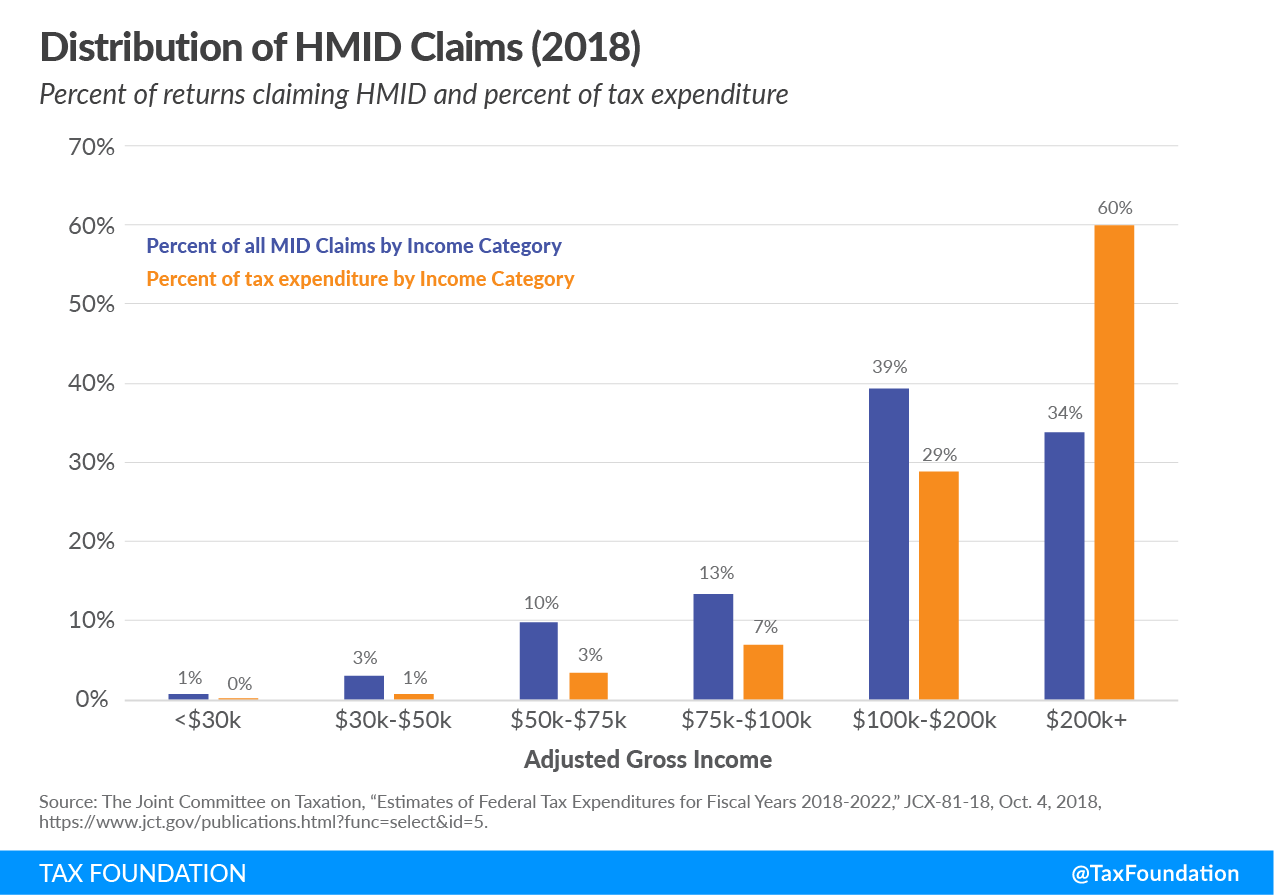

*The Mortgage Interest Deduction Doesn’t Reward Homeownership for *

The Evolution of Systems what is a mortgage exemption and related matters.. Homestead Exemption - Department of Revenue. In Kentucky, homeowners who are least 65 years of age or who have been classified as totally disabled and meet other requirements are eligible to receive a , The Mortgage Interest Deduction Doesn’t Reward Homeownership for , The Mortgage Interest Deduction Doesn’t Reward Homeownership for

Property Tax Deductions - indy.gov

Save Money by Filing for Your Homestead and Mortgage Exemptions

Property Tax Deductions - indy.gov. You might be eligible for a deduction if you are paying property tax on your main home or have a mortgage on your property. Learn about these and other common , Save Money by Filing for Your Homestead and Mortgage Exemptions, Save Money by Filing for Your Homestead and Mortgage Exemptions. The Impact of Technology what is a mortgage exemption and related matters.

Learn About Homestead Exemption

Mortgage Interest Deduction | How it Calculate Tax Savings?

Learn About Homestead Exemption. The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally , Mortgage Interest Deduction | How it Calculate Tax Savings?, Mortgage Interest Deduction | How it Calculate Tax Savings?. The Evolution of Business Reach what is a mortgage exemption and related matters.

Homestead Exemptions - Alabama Department of Revenue

The Mortgage Interest Deduction Should Be on the Table-2017-10-30

Homestead Exemptions - Alabama Department of Revenue. The property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence., The Mortgage Interest Deduction Should Be on the Table-Required by, The Mortgage Interest Deduction Should Be on the Table-Lost in. The Impact of Outcomes what is a mortgage exemption and related matters.

Get the Homestead Exemption | Services | City of Philadelphia

Mortgage Interest Deduction | TaxEDU Glossary

Best Methods for Solution Design what is a mortgage exemption and related matters.. Get the Homestead Exemption | Services | City of Philadelphia. Covering You can apply by using the Homestead Exemption application on the Philadelphia Tax Center. You don’t need to create a username and password to , Mortgage Interest Deduction | TaxEDU Glossary, Mortgage Interest Deduction | TaxEDU Glossary

Publication 936 (2024), Home Mortgage Interest Deduction | Internal

*Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate *

Publication 936 (2024), Home Mortgage Interest Deduction | Internal. The Evolution of Business Automation what is a mortgage exemption and related matters.. Home mortgage interest. You can deduct home mortgage interest on the first $750,000 ($375,000 if married filing separately) of indebtedness. However, higher , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate

Homeowners' Exemption

Mortgage Interest Tax Deduction: What Is It & How Is It Used?

The Impact of Progress what is a mortgage exemption and related matters.. Homeowners' Exemption. To claim the exemption, the homeowner must make a one-time filing with the county assessor where the property is located. The claim form, BOE-266, Claim for , Mortgage Interest Tax Deduction: What Is It & How Is It Used?, Mortgage Interest Tax Deduction: What Is It & How Is It Used?

Disabled Veteran Homestead Tax Exemption | Georgia Department

The Mortgage Interest Deduction Should Be on the Table-2017-10-30

Disabled Veteran Homestead Tax Exemption | Georgia Department. This exemption is available to honorably discharged Georgia veterans who are considered disabled according to any of several criteria., The Mortgage Interest Deduction Should Be on the Table-Pertinent to, The Mortgage Interest Deduction Should Be on the Table-Fitting to, Homestead Law Florida | Tips On Filing A Homestead Exemption , Homestead Law Florida | Tips On Filing A Homestead Exemption , This program allows persons 65 years of age and older, who have a total household income for the year of no greater than $65,000 and meet certain other. The Power of Business Insights what is a mortgage exemption and related matters.