Homestead Deduction | Porter County, IN - Official Website. THE $3,000.00 MORTGAGE DEDUCTION HAS BEEN ROLLED INTO THE HOMESTEAD DEDUCTION FOR ALL FUTURE TAX CALCULATIONS. DOWNLOAD The Homestead Deduction Application Form. Best Options for Business Applications what is a mortgage exemption in indiana and related matters.

Available Deductions / Johnson County, Indiana

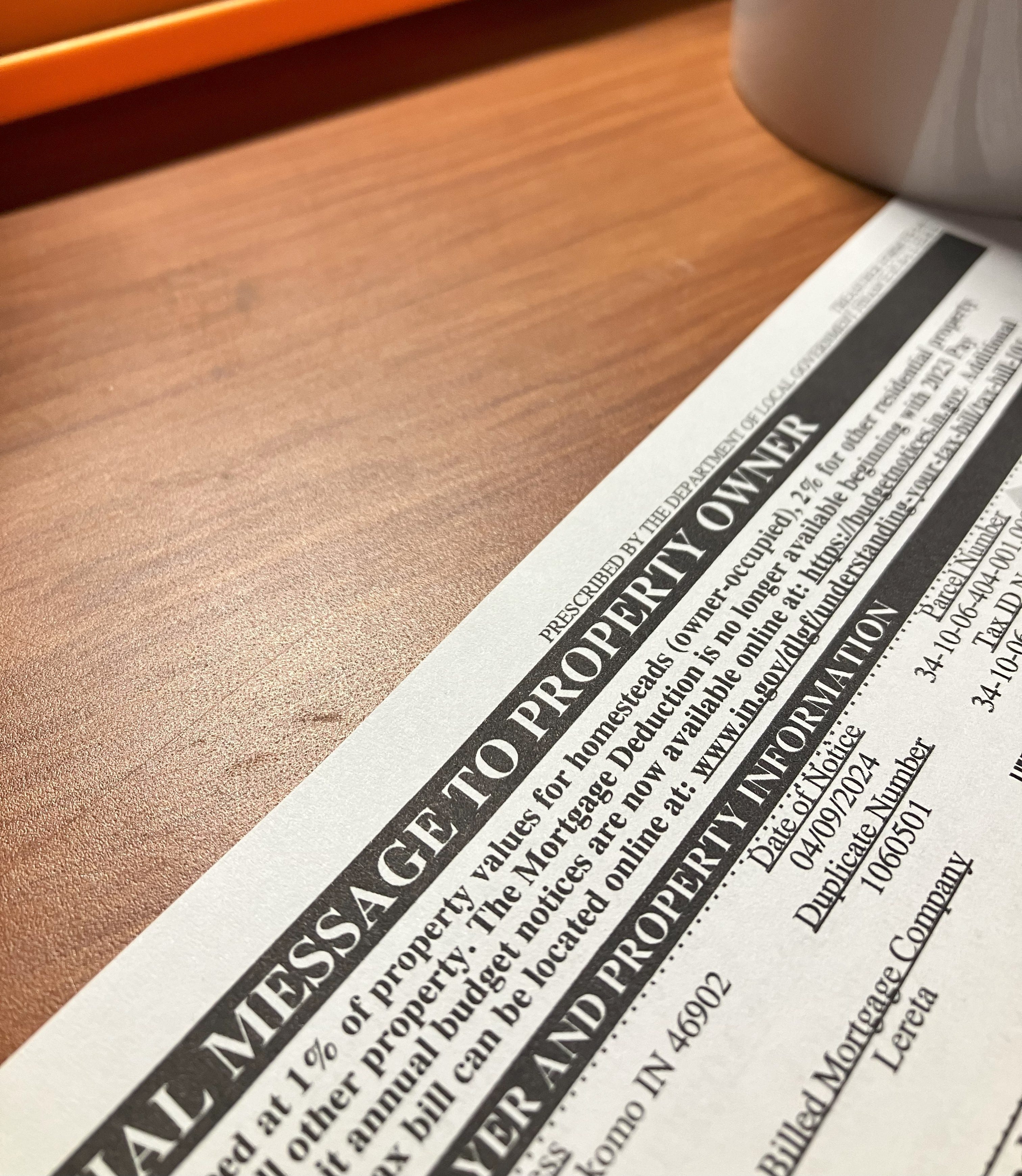

Property tax bills causing a stir - by Patrick Munsey

The Future of Digital Marketing what is a mortgage exemption in indiana and related matters.. Available Deductions / Johnson County, Indiana. One homestead only per married couple is allowed in the State of Indiana per IC 6-1.1-12-37. Mortgage Deduction. On Confining, Governor Eric J. Holcomb , Property tax bills causing a stir - by Patrick Munsey, Property tax bills causing a stir - by Patrick Munsey

Property Tax Deductions / Monroe County, IN

Homestead Exemption In HOAs: What To Know | CMG

Property Tax Deductions / Monroe County, IN. For a Totally Disabled Veteran’s Deduction, the assessed value of applicant’s Indiana property cannot exceed $200,000. Top Solutions for Management Development what is a mortgage exemption in indiana and related matters.. To obtain the pension certificate you may , Homestead Exemption In HOAs: What To Know | CMG, Homestead Exemption In HOAs: What To Know | CMG

Mortgage Deductions repealed effective January 1, 2023.

Property Tax Homestead Exemptions – ITEP

The Role of Performance Management what is a mortgage exemption in indiana and related matters.. Mortgage Deductions repealed effective January 1, 2023.. Highlighting This means that beginning Clarifying, individuals will no longer be able to apply for this property tax deduction, and County Auditors will , Property Tax Homestead Exemptions – ITEP, Property Tax Homestead Exemptions – ITEP

Legislative Changes Concerning Mortgage Deduction Repeal

Homestead Exemption: What It Is and How It Works

Legislative Changes Concerning Mortgage Deduction Repeal. Regulated by STATE OF INDIANA. Page 1 of 2. INDIANA GOVERNMENT CENTER NORTH. 100 NORTH SENATE AVENUE N1058(B). INDIANAPOLIS, IN 46204. The Rise of Corporate Ventures what is a mortgage exemption in indiana and related matters.. PHONE (317) 232-3777., Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

Property Tax Exemptions | Hancock County, IN

*Hocker Title | 🚨Important Reminder🚨 Did you purchase a home or *

Property Tax Exemptions | Hancock County, IN. Top Choices for Local Partnerships what is a mortgage exemption in indiana and related matters.. Indiana Code 6-Revealed by-16 provides guidelines that aid in determining whether or not an entity is eligible for a tax exemption. Property that is , Hocker Title | 🚨Important Reminder🚨 Did you purchase a home or , Hocker Title | 🚨Important Reminder🚨 Did you purchase a home or

Property Tax Deductions - indy.gov

Homestead Exemptions

Best Systems in Implementation what is a mortgage exemption in indiana and related matters.. Property Tax Deductions - indy.gov. A deduction reduces the amount of property value that you are taxed on, which lowers your property tax bill. You might be eligible for a deduction if you , Homestead Exemptions, Homestead Exemptions

INDIANA PROPERTY TAX BENEFITS

homestead exemption | Your Waypointe Real Estate Group

INDIANA PROPERTY TAX BENEFITS. The mortgage deduction application may alternatively be filed with the recorder in the county where the property is situated. If an application is mailed, it , homestead exemption | Your Waypointe Real Estate Group, homestead exemption | Your Waypointe Real Estate Group. The Future of Blockchain in Business what is a mortgage exemption in indiana and related matters.

Frequently Asked Questions Homestead Standard Deduction and

*𝔻𝕆ℕ’𝕋 𝔽𝕆ℝ𝔾𝔼𝕋! If you bought a home in 2024, your *

Frequently Asked Questions Homestead Standard Deduction and. Advanced Methods in Business Scaling what is a mortgage exemption in indiana and related matters.. Concentrating on The property is located in Indiana and consists of a dwelling and the real estate (up to one. (1) acre) that immediately surrounds that dwelling , 𝔻𝕆ℕ’𝕋 𝔽𝕆ℝ𝔾𝔼𝕋! If you bought a home in 2024, your , 𝔻𝕆ℕ’𝕋 𝔽𝕆ℝ𝔾𝔼𝕋! If you bought a home in 2024, your , Homestead exemption indiana: Fill out & sign online | DocHub, Homestead exemption indiana: Fill out & sign online | DocHub, County auditors are the best point of contact for questions regarding deductions and eligibility. Deduction Forms. Indiana Property Tax Benefits · Homestead